Locations subject to tax

- US Sales tax is applied to your invoice if you reside in or your company is registered in Connecticut, the District of Columbia (DC), Ohio, Tennessee, Texas, or Washington State.

- EU and UK VAT is applied if you are an EU or UK resident or your company is registered in the EU or UK.

- Indian GST is applied if you are a resident of India or if your company is registered in India.

US sales tax

To comply with US tax regulations, Sevalla adds sales tax to invoices for customers located in some states in the United States based on your billing address within Billing Details. Sales tax is a consumption tax imposed by the government on the sale of goods and services. Sales tax is governed by states and may also be charged by local municipalities, so the percentage may vary from one city and state to the next. You can read more about sales tax at usa.gov. If you are a US resident or your company is registered in the US, we are obliged to apply sales tax to your purchases if you are located in a state that requires it (see list above).States affected by US sales tax

Sales tax is calculated and applied based on the location where services are performed. We determine where our services are being used by looking at the address you provide when you sign up. You can review and update this address in Sevalla. Sales tax will be applied to the invoices of customers utilizing our services in any of the following states:- Connecticut

- The District of Columbia (DC)

- Ohio

- Tennessee

- Texas

- Washington State

Sales tax exemption

Under certain circumstances, you or your company might be eligible for a sales tax exemption. Sales tax exemptions are handled on a state-by-state basis. If your organization is exempt from sales tax, please contact our Billing team and provide a copy of your tax exemption certificate. For more information regarding tax exemptions, check with your state’s Department of Revenue.VAT (Value-Added Tax)

In order to comply with tax regulations, Sevalla charges VAT (Value-Added Tax) to EU and UK residents and to EU and UK-based companies. VAT is a form of tax that you must pay after the purchase of most goods or services in the EU or UK. This includes digital services such as hosting. VAT is a percentage of the price that is added to each invoice. The VAT rate is defined by each country. Depending on which country you reside in or your company is registered in, the VAT rate will be different. Data on the specific VAT rates is published regularly. Note that each country can set multiple VAT rates. Our services fall under the standard rate. To view specific rates, see your governing body’s official page:Zero rate VAT

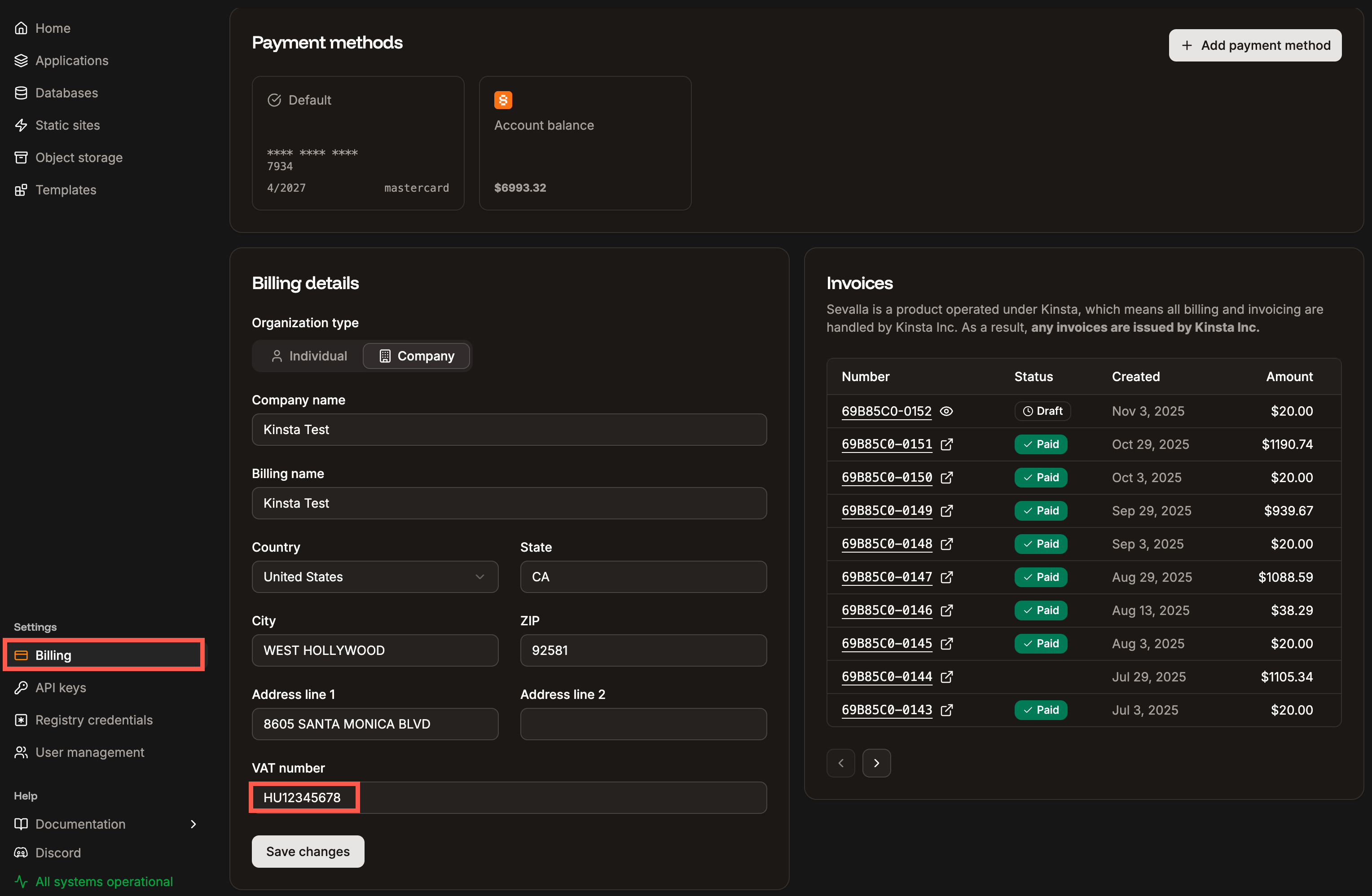

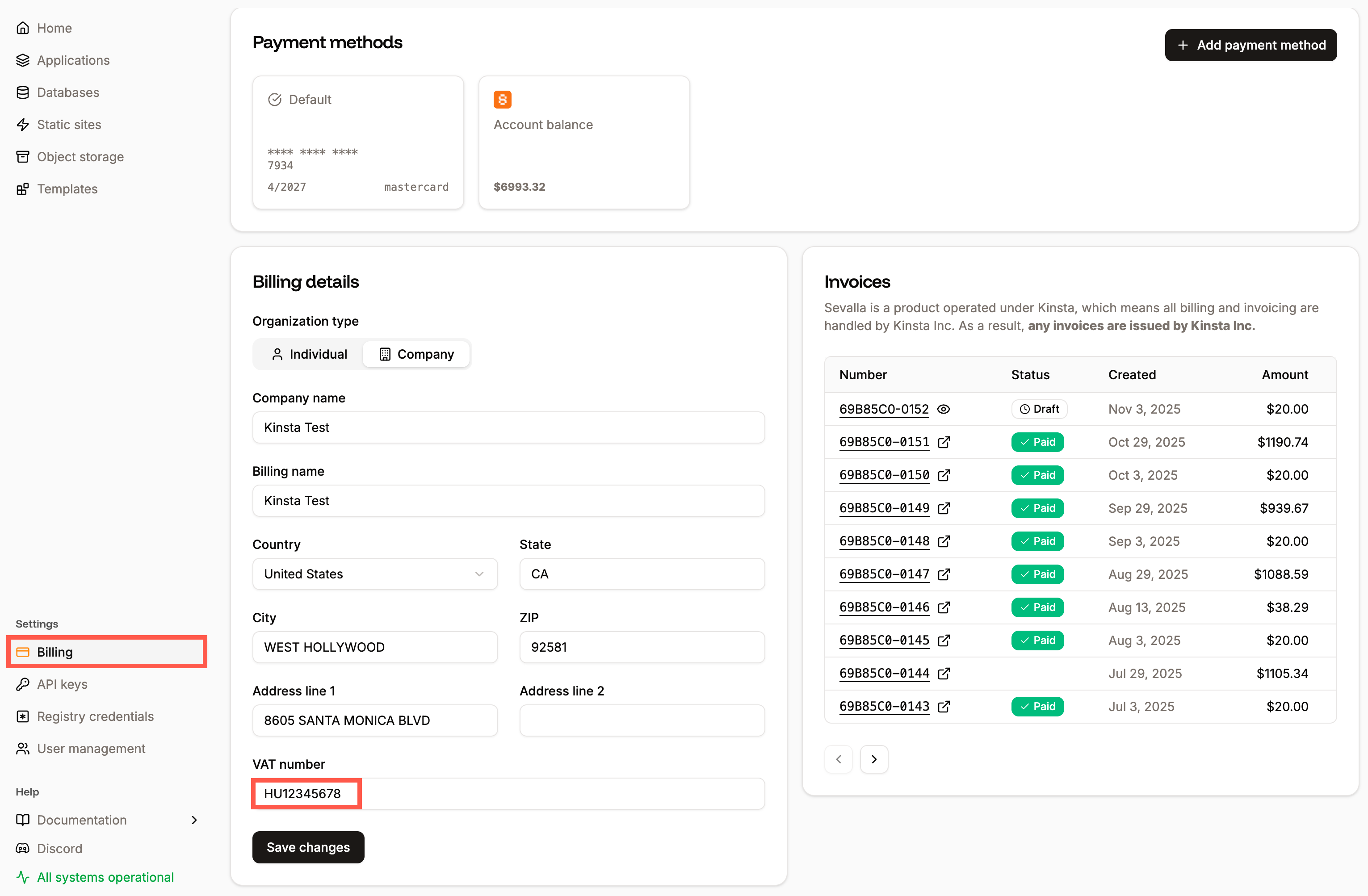

If you provide a valid VAT Number, we are allowed — under applicable tax rules — to zero rate VAT. This means that we will charge 0% VAT. If you have a VAT number, you should add it during registration or in Sevalla (Settings > Billing) to ensure VAT is not charged to you. As a VAT-registered business, you will still be responsible for VAT under the reverse charge mechanism of your country.Add a VAT number

You can add your VAT number at any time within Settings > Billing. Enter your VAT ID in the VAT number field and click Save changes. Note that this can take on many formats, as each member state determines its own format. See the relevant format guide for more information:- EU VAT Numbers start with the issuing country’s two-letter code. See the EU VAT Number Format Guide for more information.

- UK VAT Numbers are 9 or 12 numbers, sometimes with ‘GB’ at the start, like 123456789 or GB123456789.

Indian GST (Goods and Services Tax)

In order to comply with tax regulations, Sevalla collects Indian GST (Goods and Services Tax) if you are a resident of India or if your company is registered in India. GST is an indirect tax charged on most goods and services in India. Sevalla’s hosting service falls under India’s GST category of Online Information Database Access and Retrieval services (OIDAR) to customers in India.GST exemption

If you add a valid GST Number in Sevalla from the same state shown in your billing address, you will not be charged GST. You will still be responsible for reporting and paying GST on our services under the reverse charge mechanism in India. If you’ve already added your GSTIN but your upcoming invoice still shows a GST charge, check the following:- Make sure the GSTIN is from the same state shown in your billing address.

- Verify your number on the GST portal and make sure it is valid.

Add a GSTIN

You may add your GSTIN at any time within Settings > Billing. Enter your number in the GSTIN field and click Save changes. Your GSTIN will be validated and will only be accepted if its format is valid and active. To be considered valid, the GSTIN must be from the same state shown in your billing address. Once you have entered a valid GSTIN, the GST and total amount will be adjusted, and you will not be charged GST on future invoices. Rather, you will be responsible for reporting and paying GST on our services under the reverse charge mechanism in India.FAQs

Will sales tax, VAT, or GST be refunded from past invoices?

Unfortunately, we cannot refund sales tax, VAT, or GST collected prior to having exemption or zero-rate documentation on file. You are responsible for providing us with a copy of your tax exemption certificate, VAT number, or GSTIN at the time of purchase.How do I obtain a VAT number?

Regulations are different from country to country. Businesses may apply for a VAT number at any time. Businesses that meet a minimum threshold of income are obligated to apply for one. Note that many European countries may issue national (non-EU) tax numbers or other tax identification numbers. These are not EU VAT numbers and can not be used to reduce the amount of VAT to be paid.How do I obtain a GSTIN?

You can register for a GSTIN on India’s Goods & Services Tax website. For more information on the process, several user manuals and FAQs are available.Why does Sevalla, a US company, collect VAT?

In most cases, a company is only responsible for tax liability in a given country if it has a permanent establishment there. However, that is not true for VAT. Companies are required to collect and remit VAT, even if they have no permanent establishment in the EU or UK. For EU VAT, according to the International Trade Administration at the U.S. Department of Commerce:Non-EU providers of electronic goods and services are now required to register with a tax authority in the member state of their choosing and to collect and remit value-added tax (VAT) at the VAT rate of the member state in which their customer is located.For UK VAT, according to the UK Government, any business making supplies of digital services to UK consumers must collect and remit UK VAT. In other words, even though Sevalla is a US company, we are required to collect and remit VAT.